do you pay property taxes on a leased car in ct

If the lease agreement states that you are responsible for these taxes you will receive an invoice from the. In all cases the tax advisor charges the taxes to the dealer and the dealer pays.

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

If you terminate your lease.

. Some states like mine have a personal property tax on vehicles. Furthermore sales tax will be added to each monthly lease payment. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing.

Even if the vehicle is not. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. Cars trucks RVs boats etc.

If you paid less than 635 or 775 for vehicles over 50000 sales tax in another state you will need to pay the additional tax to DMV when the vehicle is registered. All tax rules apply to leased vehicles. The local car tax is 1812 if the price is 18200 x 70.

If you are unsure of whether or not you are required to pay property taxes on your leased car you can always contact your leasing company or the DMV in your state. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

So if you live in a state with a. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. The due date of the tax is usually January 1.

When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle. There are different mill rates for different towns and cities. Owners of vehicles registered between October 2 and July 31 pay a prorated amount depending on the date of registration of the vehicle.

In California the sales tax is 825 percent. In all cases the tax assessor will bill the dealership for the taxes and the dealership. Joined Jul 16 2011.

11 Nov 6 2012. The terms of the lease will decide the responsible party for personal property taxes. People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise.

Leased and privately owned cars. If you didnt get.

Car Accidents With Leased Cars Adam Kutner Attorneys

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

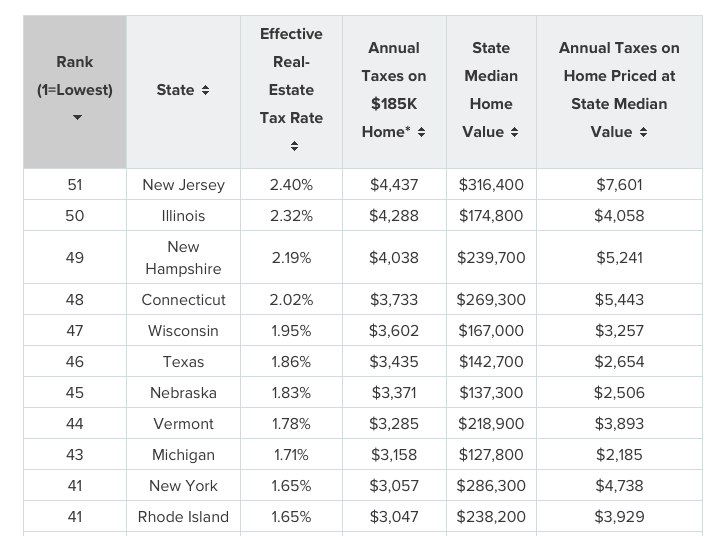

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Is Leasing A Car A Good Idea Experian

Leasing A Car And Moving To Another State What To Know And What To Do

When Should You Lease Your Car Here S The Best Time To Do It Shift

Leasing A Car And Moving To Another State What To Know And What To Do

What You Should Know About Short Term Car Leases Forbes Advisor

There S A Plan To Get Rid Of Property Tax On Cars But How Would Towns Make Up The Difference

Should You Lease Or Buy A Car Pros And Cons Of Leasing Vs Buying

Tangible Personal Property State Tangible Personal Property Taxes

City Of Hartford Tax Bills Search Pay

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Area Dealerships Overcharging Tens Of Thousands On Car Lease Buyouts 7 On Your Side Investigates Abc7 New York

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Personal Property Tax Jackson County Mo

Nj Car Sales Tax Everything You Need To Know

Leasing A Car And Moving To Another State What To Know And What To Do